Philosophy of

MissionFIRE

At Jagoinvestor, we are on a mission — that goes beyond just wealth creation.

We believe that in today’s world, achieving financial freedom is no longer optional; it is essential. It is the key to breaking free from financial stress, reclaiming control over your time, and designing a life where money is never a limitation.

While wealth creation is a crucial part of the journey, it is merely a tool to unlock true financial freedom. At its core, missionFIRE is about achieving financial independence well before the traditional retirement age, allowing you to live life on your terms during some of your prime years.

It is a disciplined, strategic approach to wealth building, ensuring that money works for you—not the other way around. missionFIRE is not just about accumulating wealth; it’s about designing a life where financial freedom gives you the power to choose—whether that means pursuing passions, spending more time with family, or transitioning into work you truly enjoy.

We believe that financial independence is a journey, not a destination. Reaching it requires clarity, discipline, and well-executed investment decisions. Through missionFIRE, we provide a structured roadmap, guiding you through the stages of financial growth, helping you build long-term wealth while avoiding distractions that derail most investors.

This philosophy has been built over years of experience, research, and real-world application, and we firmly believe in its effectiveness. It is not just a strategy—it is a mindset shift. As our client, we want you to embrace this approach, operate with this perspective, and make investment decisions that align with the ultimate goal of financial freedom.

missionFIRE is not for everyone—it’s for those who are committed to a higher financial purpose, who seek to break free from conventional retirement timelines, and who are ready to take control of their financial destiny.

We are building an army of like-minded individuals who are committed to achieving financial freedom. By joining missionFIRE, you become part of a movement that is reshaping the way people think about money, work, and life. Your aim is not just to create a big financial corpus, but also to use it effectively to create an amazing life worth living—spending it well on your passion, health, lifestyle, and travel.

missionFIRE is more than a plan—it’s a commitment to financial independence and a life of choice. If you are ready to take control of your financial destiny, we are here to guide you every step of the way.

MissionFIRE Vs Retirement

In today’s fast-paced world, traditional retirement planning is no longer enough. The idea of working hard for 30-40 years, saving just enough, and then finally “enjoying” life in your 60s is an outdated model. The reality is that money stress dominates people’s lives much earlier, affecting health, relationships, and overall happiness.

Category

Traditional Retirement

MissionFIRE

Financial Stress

Seen as a financial issue, often ignored until later in life

Recognized as an emotional and social burden that affects life much earlier

Health & Well-being

Health is neglected due to long hours, stress, and lack of time

Promotes balance, self-care, and prioritizing well-being throughout the journey

Relationships

Financial stress leads to less presence and quality time with loved ones

Encourages financial freedom to be fully present and build meaningful connections

Passions & Hobbies

Postponed until retirement—often too late to enjoy

Emphasizes living fully and pursuing passions during one’s prime years

Quality of Life

Life is spent in a survival mode, hoping for freedom after 60+

Aims to design a life of freedom, exploration, and fulfillment much earlier

How MissionFIRE fixes Your Life Beyond Money

Lack of money isn’t just financial—it’s a social and emotional weight. Financial insecurity often feels like personal failure, fueling stress, anxiety, and a life stuck in survival mode.

Health suffers as long hours, poor habits, and burnout replace self-care. Relationships strain under money worries, with time for loved ones and meaningful moments lost. Passions, hobbies, and travel get pushed to “someday,” but by retirement, many lack the energy or health to enjoy them.

The irony? The best years of life, meant for growth and exploration, often vanish under financial stress.

Money

Helps you break free from the paycheck-to-paycheck cycle, build massive wealth, and create financial security so you never have to worry again.

Relationships & Time

You don’t want to be 60+ to finally spend quality time with loved ones. MissionFIRE lets you extract the best years of your life when you have energy & freedom.

Health

Financial stress is a silent killer. When you have money in control, you can focus on fitness, diet, and mental well-being - leading to a longer, healthier life.

Personal Growth & Passion

Instead of being stuck in a 9 to 5 grind, MissionFIRE allows you to pursue hobbies, learn new skills, travel, or start passion projects without financial worries.

Core Principles of

MissionFIRE

These 10 core principles mentioned below shape your mindset and actions asa dedicated missionFIRE believer and valued client.

Embrace Volatility as a long term friend

Volatility isn’t your enemy—it makes wealth creation possible. If markets were always stable, there would be no opportunities for higher returns.

Long-term investing works because markets fluctuate, creating chances to buy low and benefit from long-term growth.

Short-term swings may feel uncomfortable, but they allow disciplined investors to accumulate wealth by staying invested and taking advantage of market dips. The biggest rewards go to those who remain calm when others panic.

Volatility separates successful investors from the rest. Those who react emotionally often miss out on big gains, while those who stay the course are rewarded. Instead of seeing downturns as setbacks, use them to strengthen your portfolio & commitment to long-term wealth.

Don’t fear volatility—welcome it. It’s not an obstacle; it’s why long-term investors succeed

Remind yourself

“ I embrace volatility as the price of wealth.I stay invested, stay patient, and let the market work in my favor.”

Never Disturb Compounding

Compounding is your greatest ally in wealth creation, but it only works if you allow it to grow uninterrupted.

Do not weaken its power by withdrawing investments for unnecessary expenses. Every time you break the compounding cycle, you delay your financial freedom.

The true magic of compounding happens in later years, where patience leads to exponential growth. Resist the urge to cash out early or react to short-term market movements. Stay committed, stay invested, and let time do the heavy lifting.

Think of your investments as a growing tree. If you keep cutting its branches, it will never reach its full height. But ifyou let it grow undisturbed, it will provide abundant shade and fruit for decades to come.

Short-term sacrifices lead to long-term rewards. The key is discipline—allow your money to work for you over time. Every year you remain invested, you increase your chances of financial success. Trust the process, avoid distractions, and letcompounding do its job.

REPEAT THIS TO YOURSELF

“I will protect my investments, allow compounding to work without interference, and stay on course until I reach financial freedom.”

Be an Active Partner in Your Financial Journey

Achieving financial freedom is not a passive process—it demands your engagement, commitment, and a willingness to learn and adapt.

While a financial advisor or investment team can provide expert guidance, your active involvement and openness to new ideas are crucial to staying on track.

A common mistake many investors make is assuming that once they start investing, they can completely delegate their financial planning.

However, true financial success comes from regularly reviewing

your portfolio, staying informed, and making well-informed decisions alongside your advisor.

Think of your financial journey as a partnership—one where you and your investment advisor collaborate to achieve your goals. But for this partnership to succeed, being coachable is key. You must be open to feedback, willing to explore new strategies, and ready to break free from rigid mindsets that may be holding you back.

REPEAT THIS TO YOURSELF

“I will stay actively involved, be available for reviews, share necessary data, and fully participate in discussions to shape my financial future”

Increase Investments as Your Income Grows

One of the biggest mistakes people make is increasing their expenses as their income rises but failing to increase their investments. This is called lifestyle inflation, and it significantly slows down wealth creation.

A simple rule: whenever your salary increases, a portion of that raise should go towards increasing your SIPs. If you maintain the same investment amount while your expenses grow, your future financial freedom will be compromised.

For example, if you earn ₹1 lakh a month and invest ₹20,000, then after a salary hike to ₹1.5 lakhs, your SIP should increase proportionally—ideally to ₹30,000 or more. This ensures that your savings rate grows in tandem with your income, allowing your wealth to compound at an accelerated rate.

By following this principle, you will reach financial independence much faster than those who merely increase their spending.

REPEAT THIS TO YOURSELF

“I commit to growing my investments every time my income rises. Every salary raise will bring me closer to financial freedom, not further from it”

See Market Crashes as Buying Opportunities

Market downturns are opportunities in disguise. Most investors panic and withdraw funds, but history proves that the best returns come from investing during market crashes.

When stock prices fall, quality assets go on sale. Instead of fearing downturns, train yourself to invest aggressively when markets decline.

Think of it like a sale on something valuable—you buy more when prices drop. The wealthiest investors build fortunes by staying invested and deploying capital in uncertainty.

Every time the market corrects, add more money. Pull from your fixed-income instruments, allocate surplus capital from bonuses, or deploy accumulated savings. This strategy will accelerate your wealth-building journey and maximize the power of compounding.

Follow this rule, and you’ll capitalize on market cycles rather than fall victim to them.

REPEAT THIS TO YOURSELF

“I will invest more during market downturns, using my savings, bonuses, or fixed income to accelerate my wealth.”

Focus on What You Can Control

The path to financial freedom becomes easier when you direct your energy toward things within your control—your income, savings rate, discipline, and investment behavior.

Too many investors waste time worrying about market movements, economic events, and news headlines, none of which they can influence.

You can’t control the markets, but you can control how you respond to them. Instead of stressing over the uncontrollable, focus on increasing your earnings, saving more, staying disciplined, and making rational investment decisions.

Control your spending habits, automate your investments, review your portfolio periodically, and stick to your long-term plan. The more you refine your financial habits, the faster you progress toward financial independence.

Success comes from smart actions, not from predicting the unpredictable. Stay focused on what truly matters, and your wealth will take care of itself.

REPEAT THIS TO YOURSELF

“I will focus only on what I can control—my savings, discipline, and actions —not on market movements or external noise.“

Monitor Your Journey with FIRE as Your Compass

Every financial decision you make should align with your

ultimate goal—financial freedom. Whether it’s buying a home, upgrading your car, or taking on new debt, ask yourself: Does this move me closer to FIRE or push me further away?

It’s easy to get caught up in short-term desires, but true financial independence comes from staying focused on the bigger picture. A luxurious purchase today could mean years of extra work tomorrow. Instead of being swayed by lifestyle temptations, view every financial choice through the lens of FIRE.

Your financial freedom is your guiding star—let it shape your decisions, not fleeting wants or social pressures.

Every rupee you spend or invest has an impact on your journey. A mindful approach to spending ensures that your money is working for you, not against you.

Prioritize assets over liabilities, growth over instant gratification, and discipline over impulse.

REPEAT THIS TO YOURSELF

“I will let FIRE guide every financial decision, staying focused on my ultimate freedom and not getting distracted by short-term desires.”

Aim for Realistic Returns

Chasing extraordinary return can lead to reckless decisions, unnecessary risk, and disappointment. Instead of aiming for unrealistic numbers, focus on steady, sustainable growth. True wealth is built over decades, not in a few lucky years.

Every investment comes with a trade-off between risk and reward. While high returns may look attractive, they often come with volatility and the risk of loss. A disciplined investor prioritizes consistency—choosing investments that compound reliably over time rather than those that promise short-term spikes.

Think of investing like climbing a mountain. If you try to sprint to the top, you risk exhaustion or even falling. But if you take steady, measured steps, adjusting for the terrain, you’ll reach the peak safely. The goal is not to get there the fastest but toensure you reach the summit without falling along the way.

By focusing on realistic, long term returns and avoiding the temptation of extreme gains, you build a portfolio that withstands market cycles and compounds effectively.

REPEAT THIS TO YOURSELF

“I commit to seeking consistent, sustainable returns, not chasing unrealistic gains. Wealth is built over decades, not overnight.”

Invest with Discipline, Not Impulse

Discipline is the key to financial success. It helps you stay on track, make smart decisions, and build wealth over time.

Many people believe they need to find the best stocks or time the market perfectly, but in reality, those who follow a steady plan often do better than those who chase quick profits. Investing consistently, saving regularly, and avoiding emotional decisions are what truly create long-term wealth.

Emotions like fear and greed often push people to make bad

choices. When markets fall, fear makes people sell at a loss. When markets rise, greed tempts them to invest recklessly.This cycle hurts long-term growth. Instead, disciplined investors stick to their strategy, invest steadily, and ignore short-term noise. Even an average investor who follows a plan can outperform a brilliant investor who keeps changing direction.

Discipline is not easy, but neither is financial freedom. Staying committed, being patient, and making smart choices now will lead to a secure and stress-free future. The best investors don’t act on impulse—they stay focused, follow their plan, and let time do the work.

REPEAT THIS TO YOURSELF

“I commit to disciplined investing, avoiding impulsive decisions, staying consistent, and trusting the process to achieve financial freedom.”

Don’t Get Lost in Perfection – Focus on Big Wins

Many investors obsess over finding the perfect fund, the highest return, or the best strategy. They tweak, optimize, and second-guess every decision, hoping to squeeze out an extra percentage point. But in doing so, they create stress, anxiety, and often, paralysis by analysis.

Instead of chasing perfection, focus on big wins—consistent savings, disciplined investing, and a well-diversified portfolio. Small optimizations won’t matter if you’re not nailing the

fundamentals.

The truth is, there’s no perfect investment—only good enough ones that compound over time. Wealth is built through patience and consistency, not endless fine-tuning. Let go of perfection and focus on progress.

Every decision you make should serve your bigger goal— financial freedom. Spending too much time searching for the absolute best can distract you from what truly matters: staying invested, sticking to your strategy, and letting time work in your favor.

REPEAT THIS TO YOURSELF

“I commit to avoiding over-optimization and unnecessary tweaks, focusing instead on big wins that truly drive financial success.”

How it works?

MissionFIRE process

Define your goals, assess your finances, and create a tailored plan.

Invest strategically, then monitor and adjust to reach financial freedom.

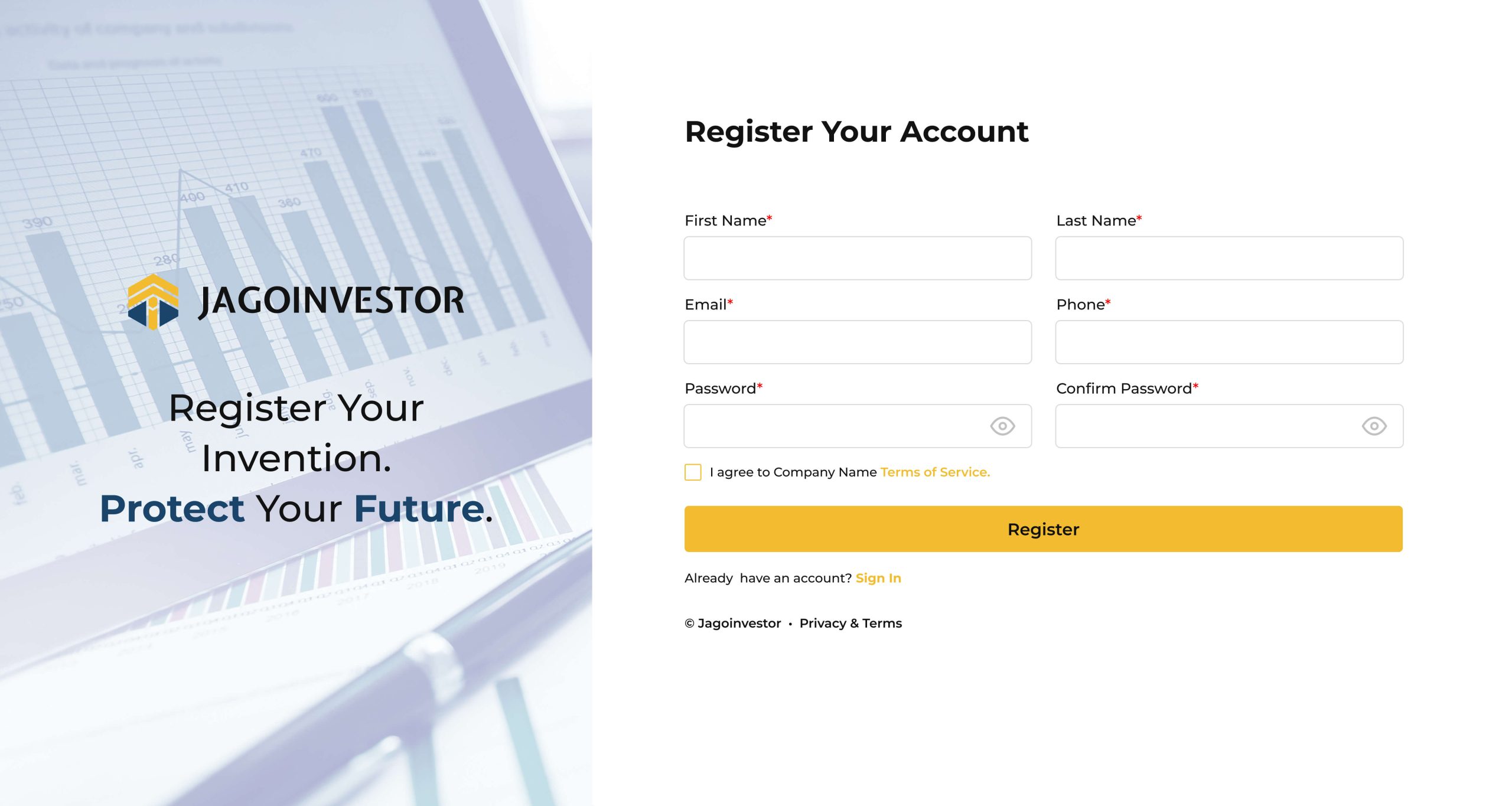

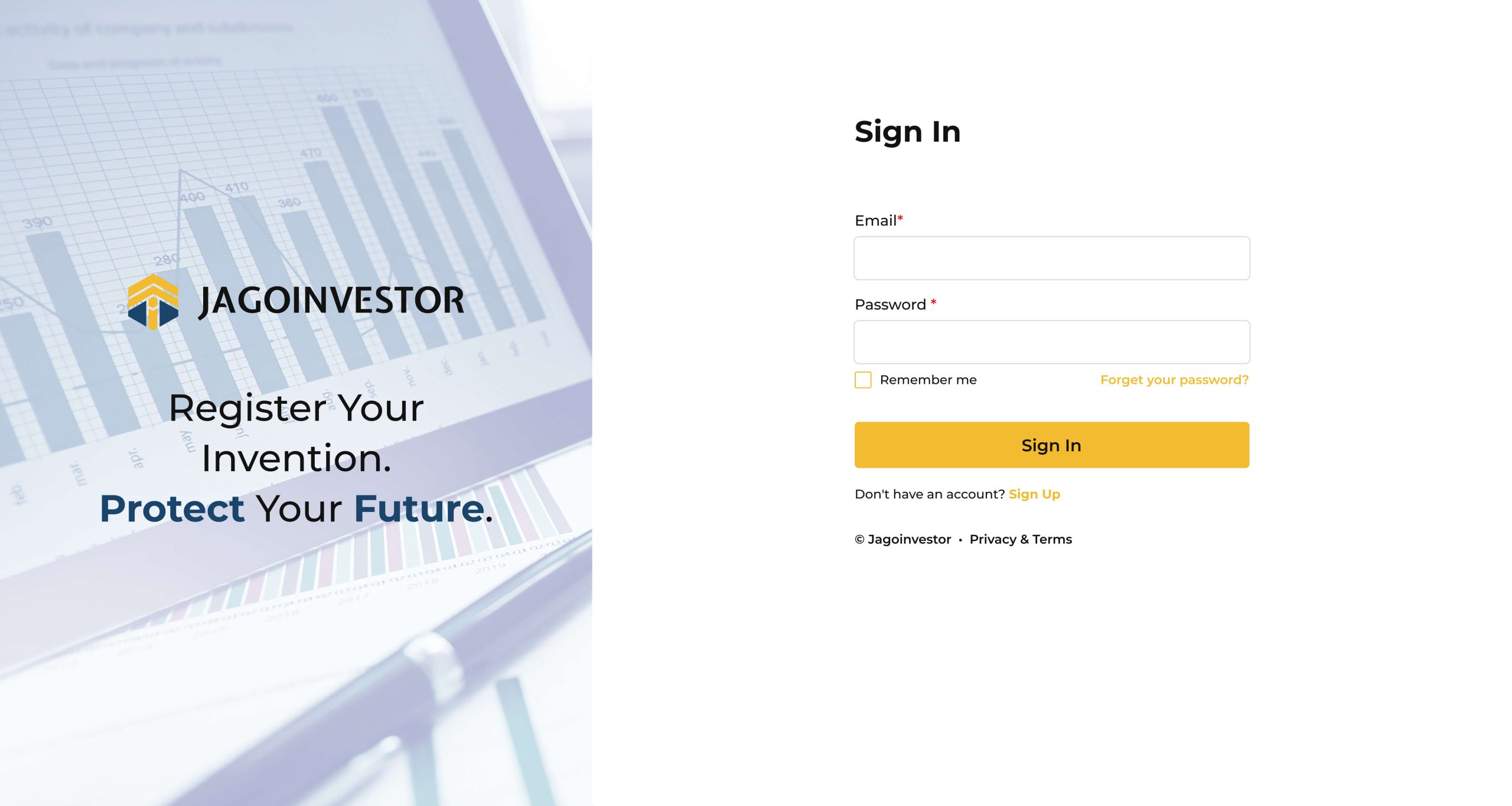

Register

Sign In

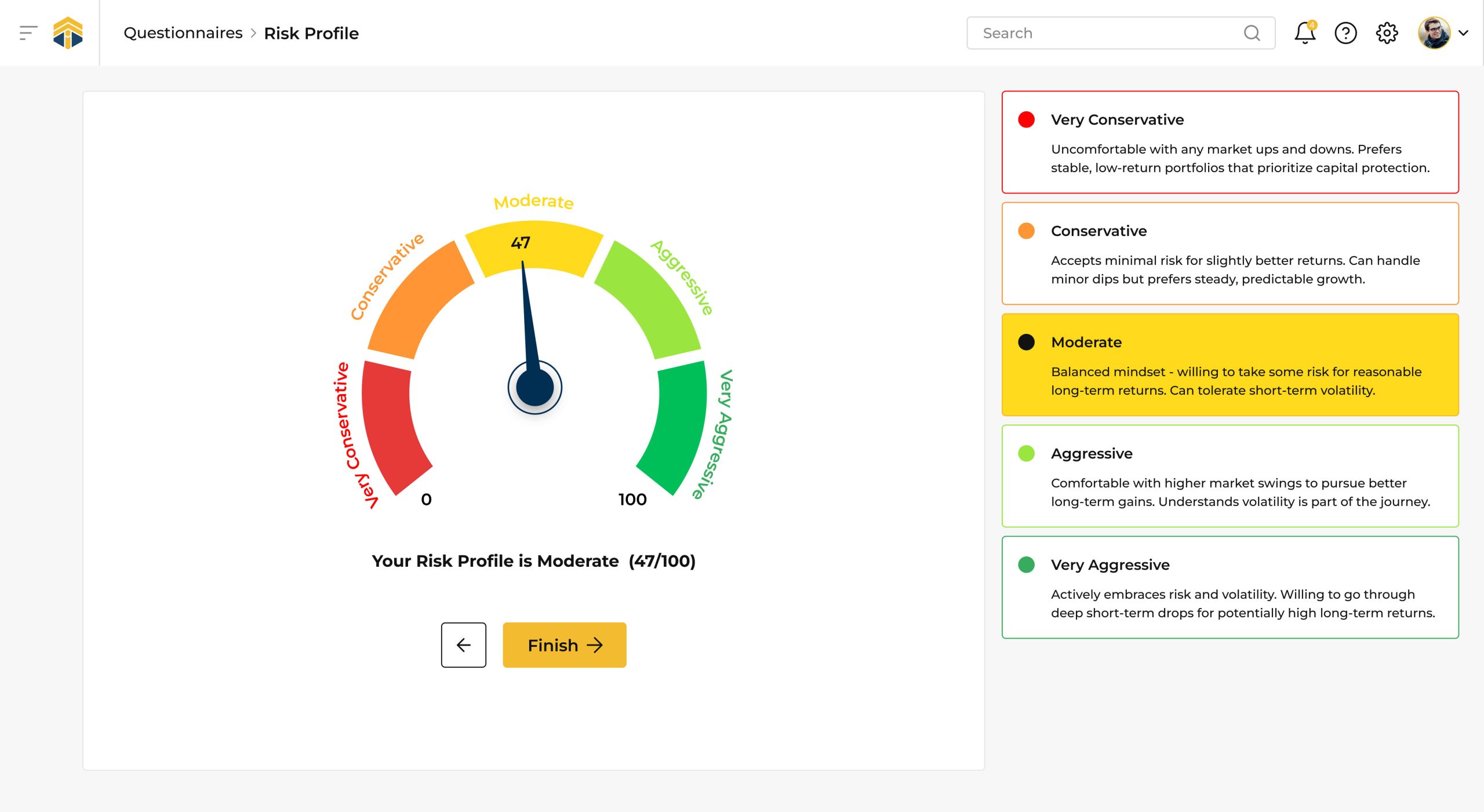

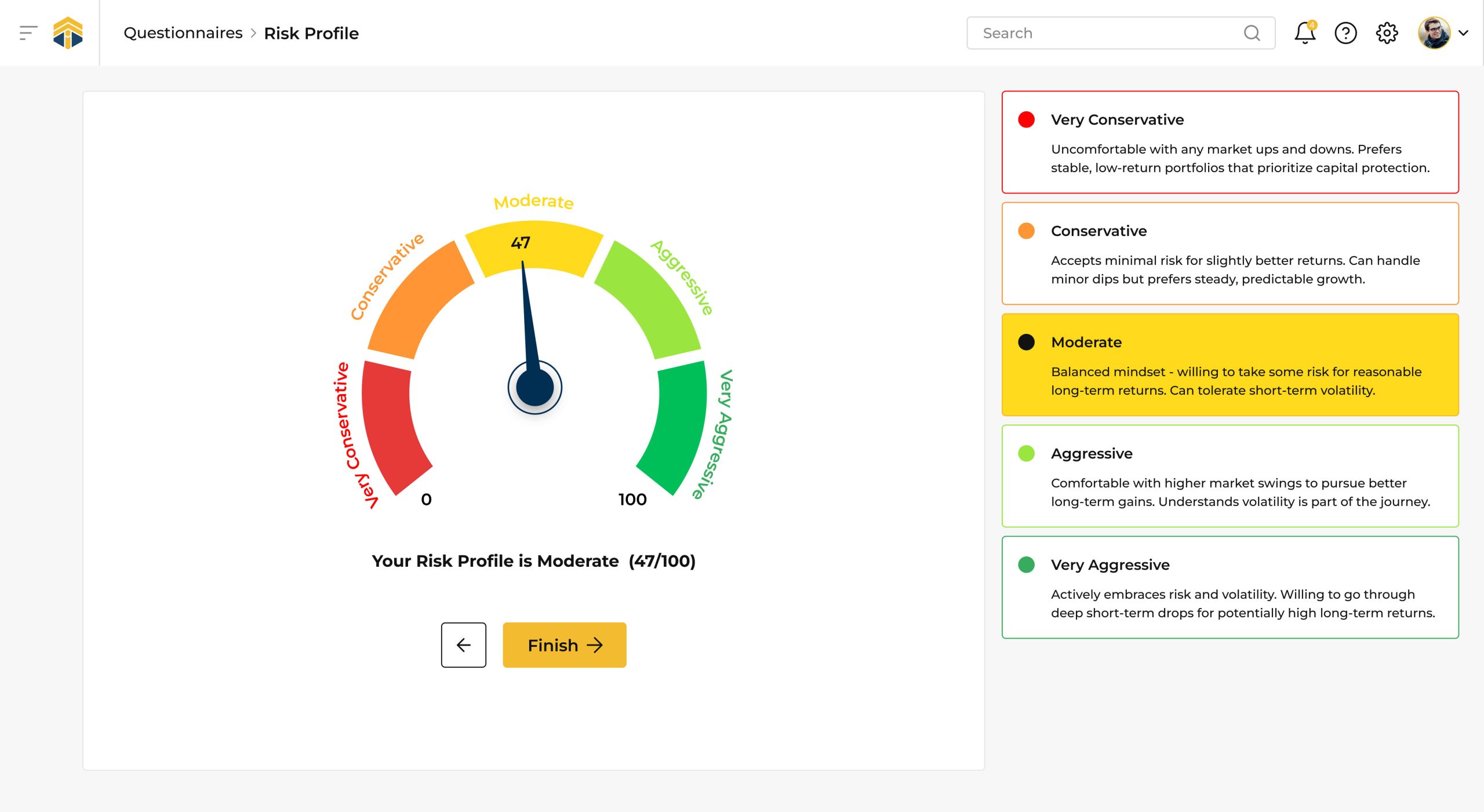

Risk Profile

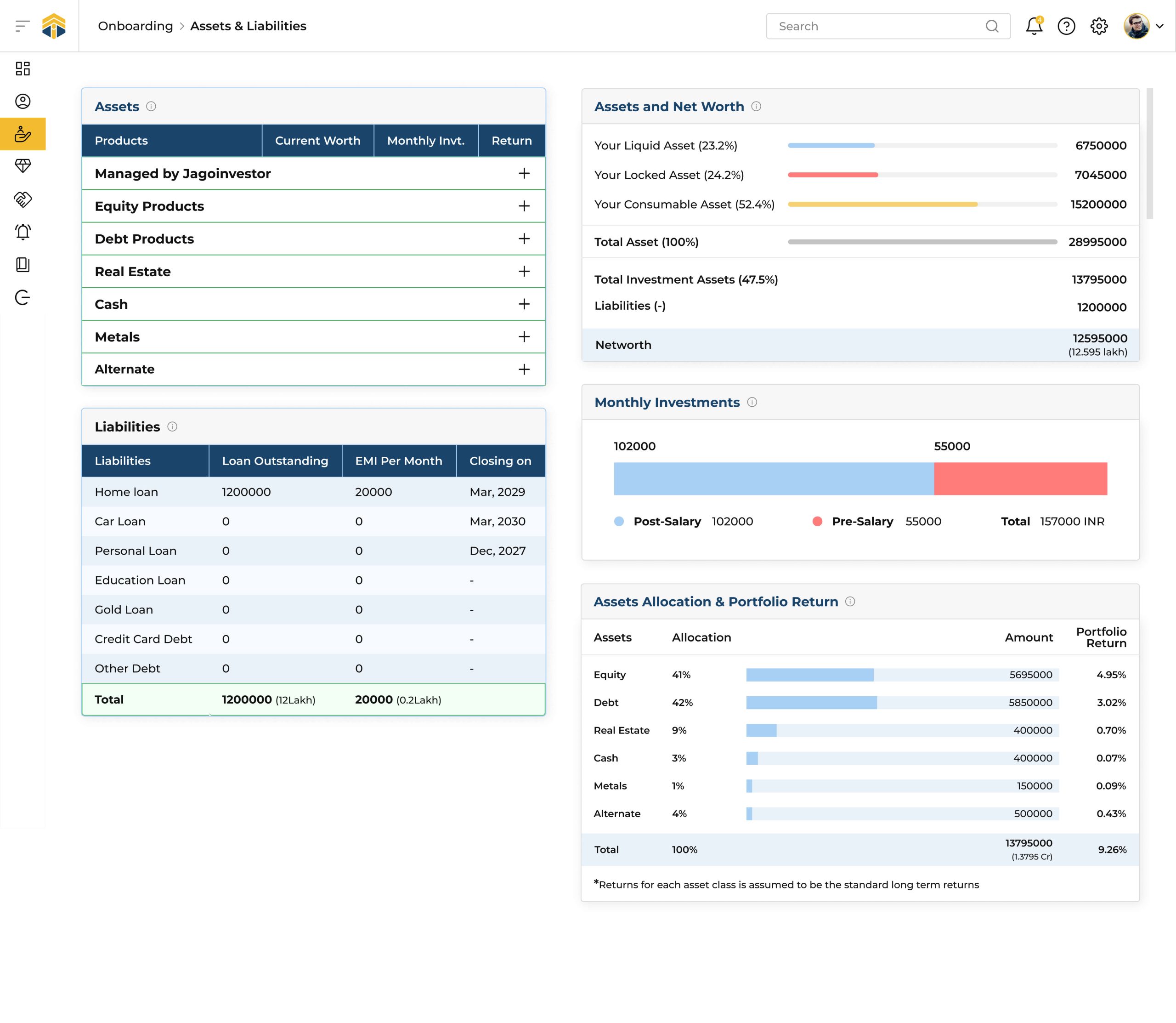

Assets /

Liabilities

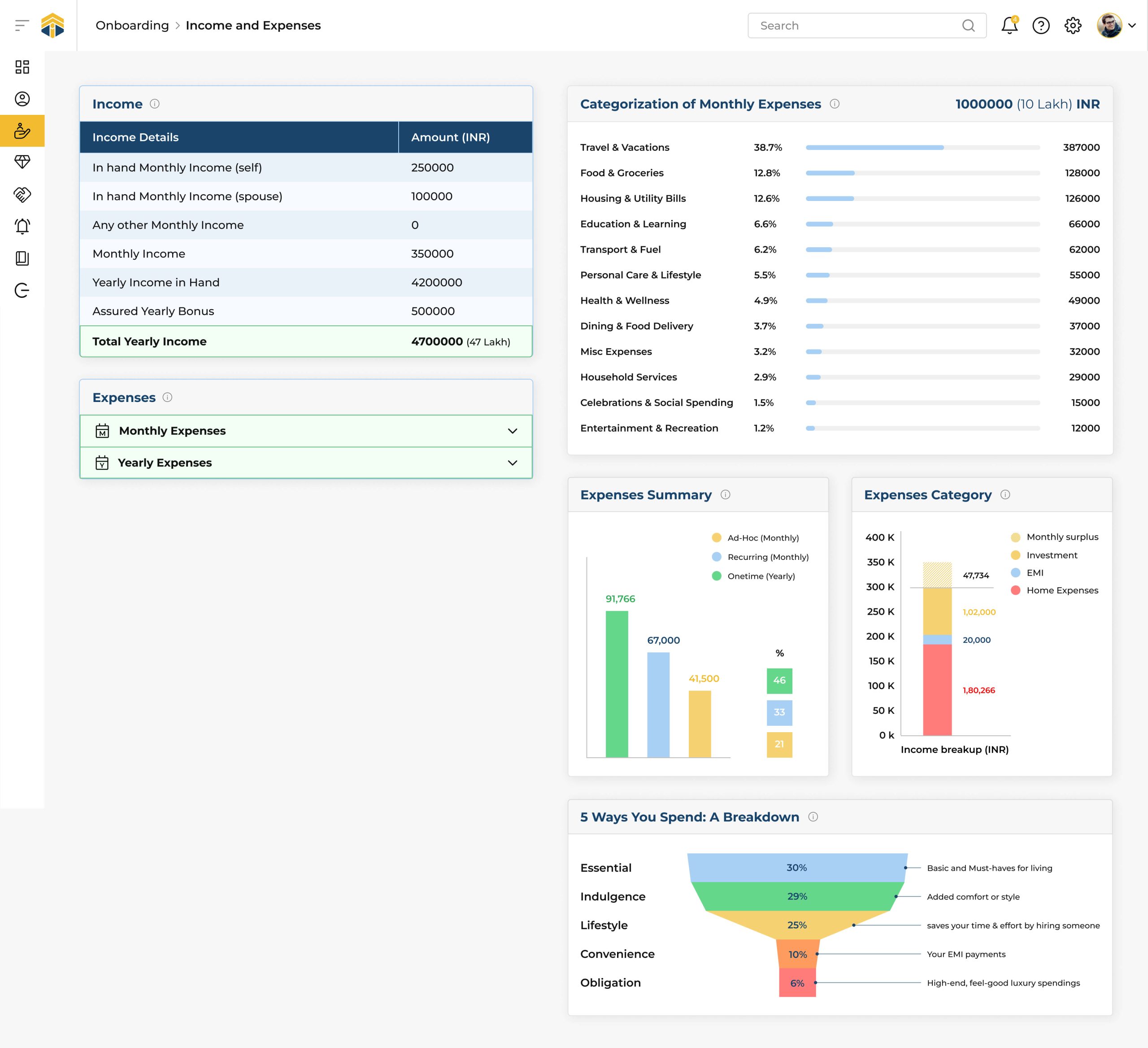

Income / Expenses

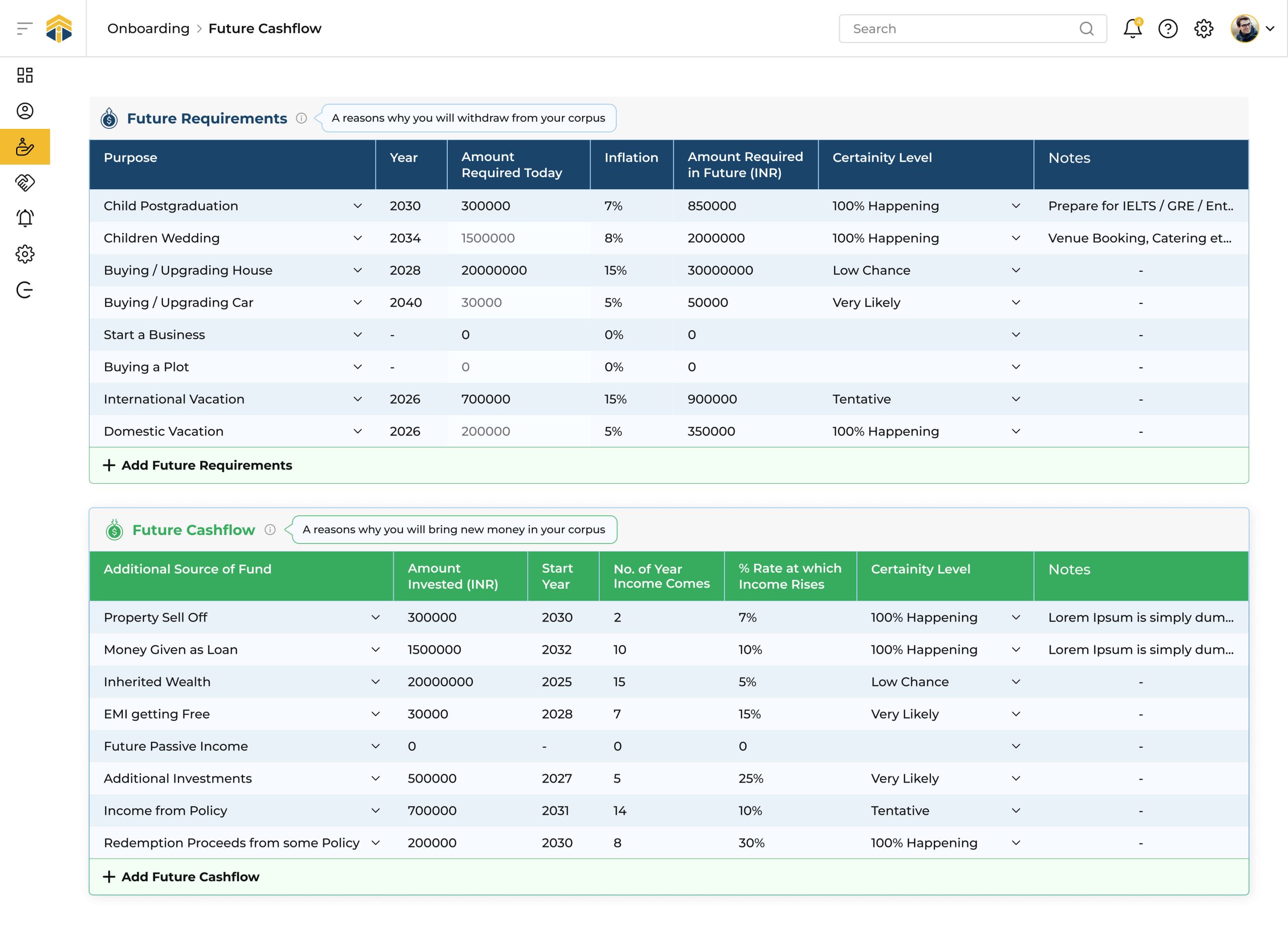

Future

Cashflow

MissionFIRE Project insights

MissionFIRE Courses

Testimonial

MissionFIRE helps individuals take control of their finances and design a path toward early, stress-free retirement through smart strategies and expert guidance.

Rubina D

Manager

Rubina D

Manager

MissionFIRE WealthNote